EMR August 2022

Dear Reader

ECONOMIC FRAMEWORK

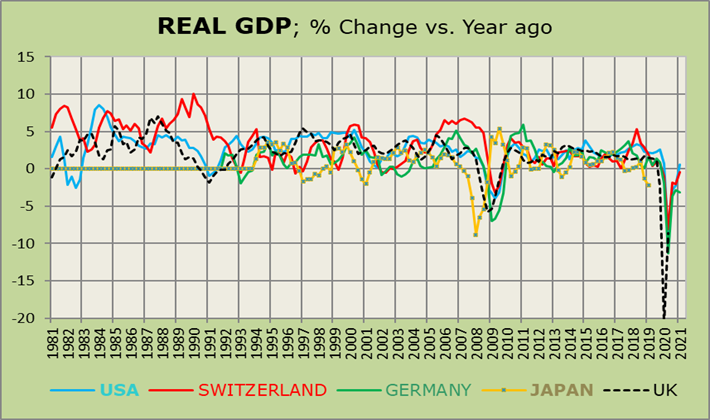

The monetary authorities have recently begun to raise interest rates in unprecedented steps. The declared aim is to contain the ongoing retail price increases. The reactions by the monetary authorities can be interpreted as an indicator of tightened monetary policy. One could argue that the specific objective is to disentangle the links between the financial sector and the development of the real economy.

Why is this so? Well, they provide very valuable information about the interaction between the supply of savings and the demand for investment. Theoretically, there is broad agreement on the factors that influence interest rates, while disagreement concern the relative importance of the various instruments.

TODAY´S ENVIRONMENT

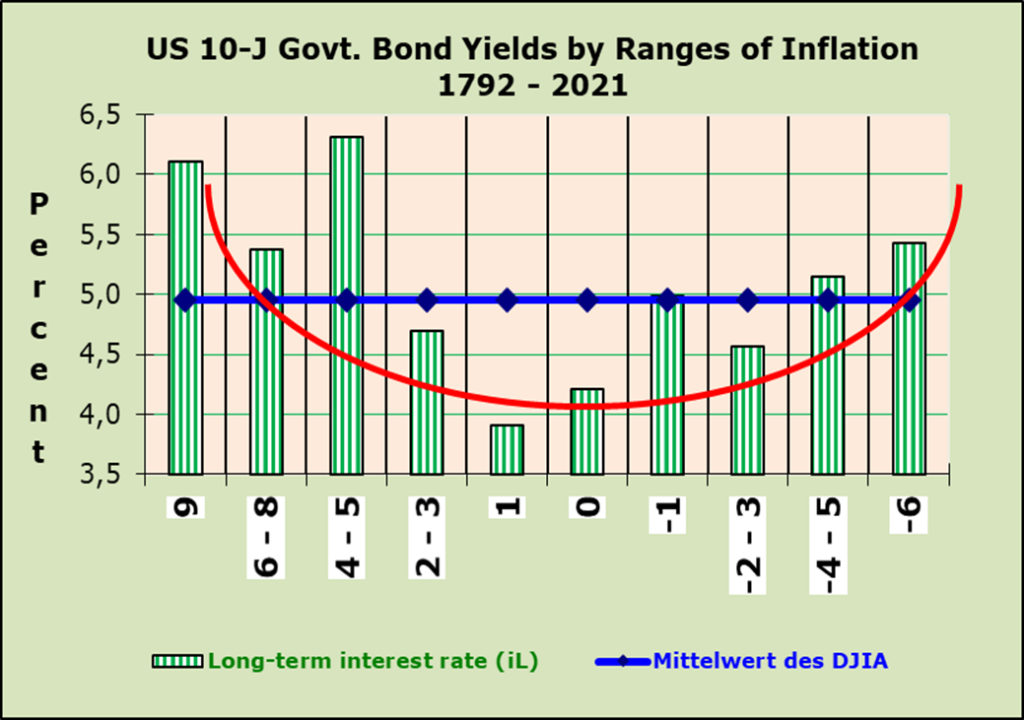

We believe that the recent and the foretold actions of the Central Bank (specifically of the Federal Reserve) to push interest rates on deposits of the banking industry higher, must be defined as a tightening indicator. The real puzzle of this tightening lies in the specific reactions of the market. We might ask whether it is reasonable to assume that further increases in interest rates will reduce the supply of money?

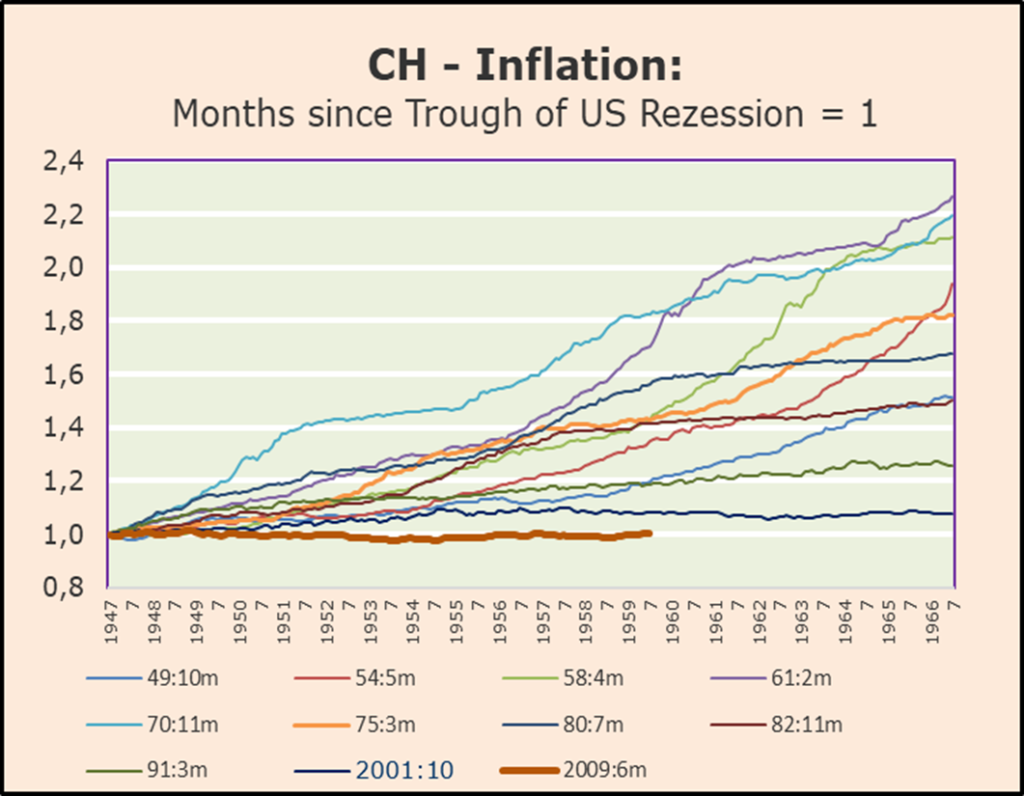

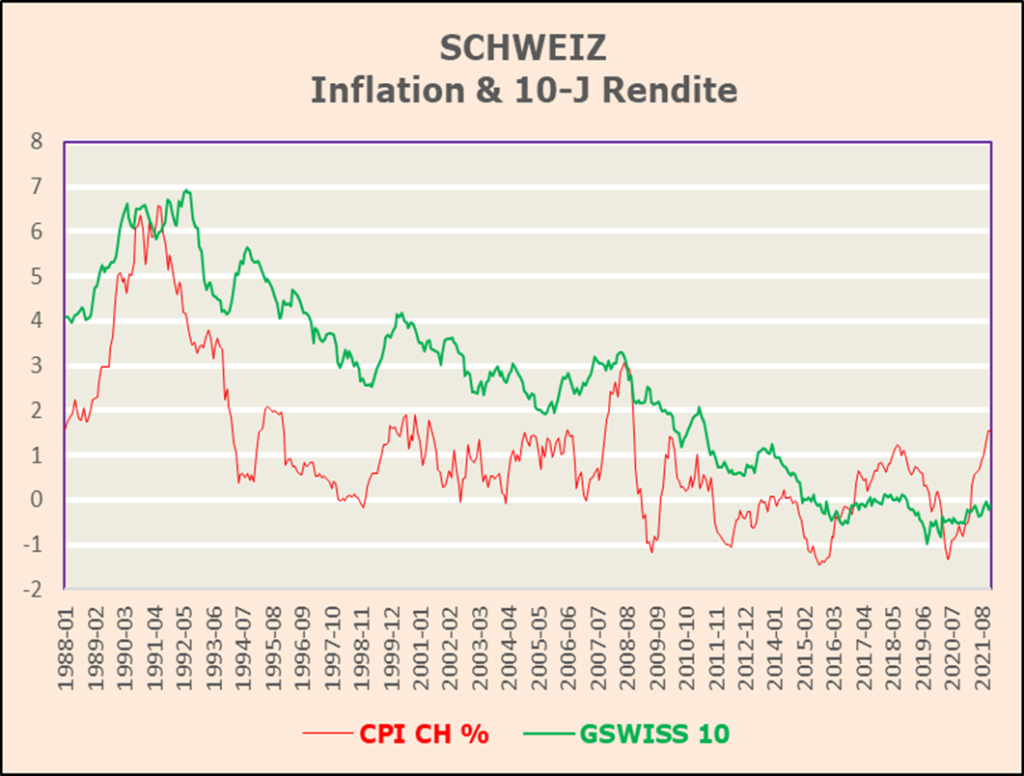

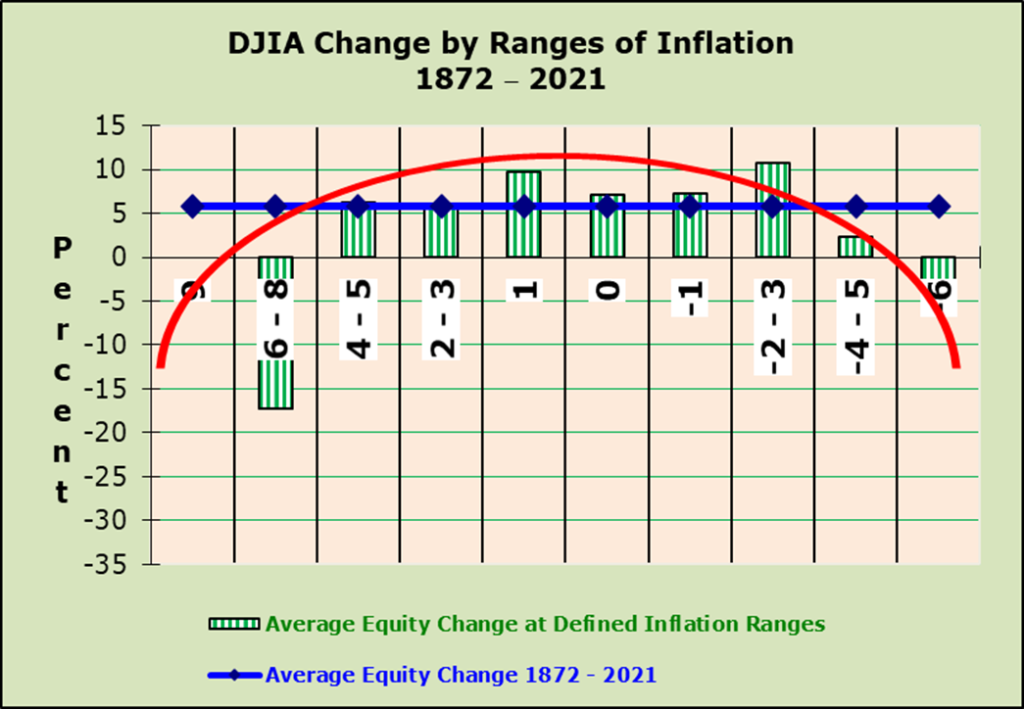

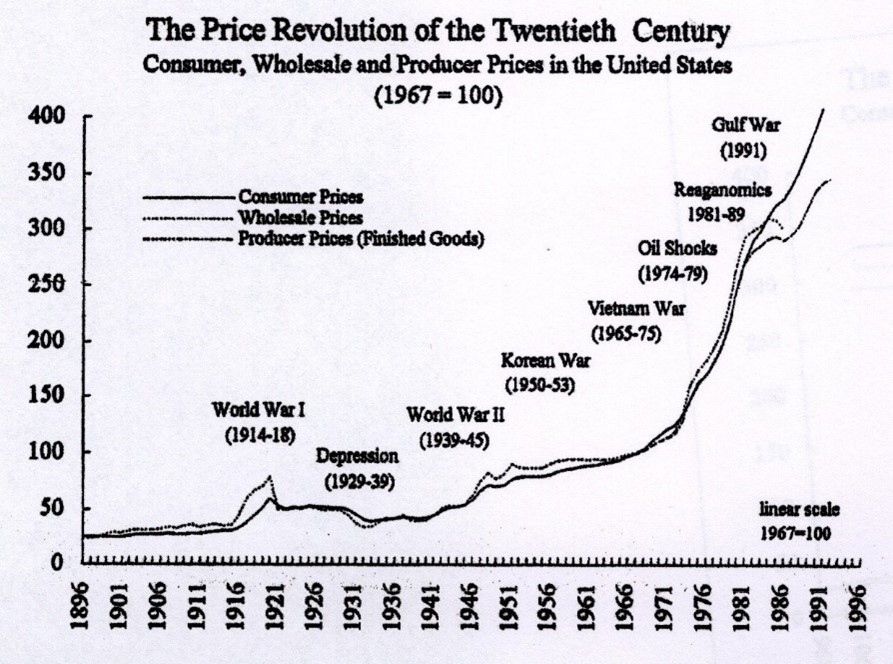

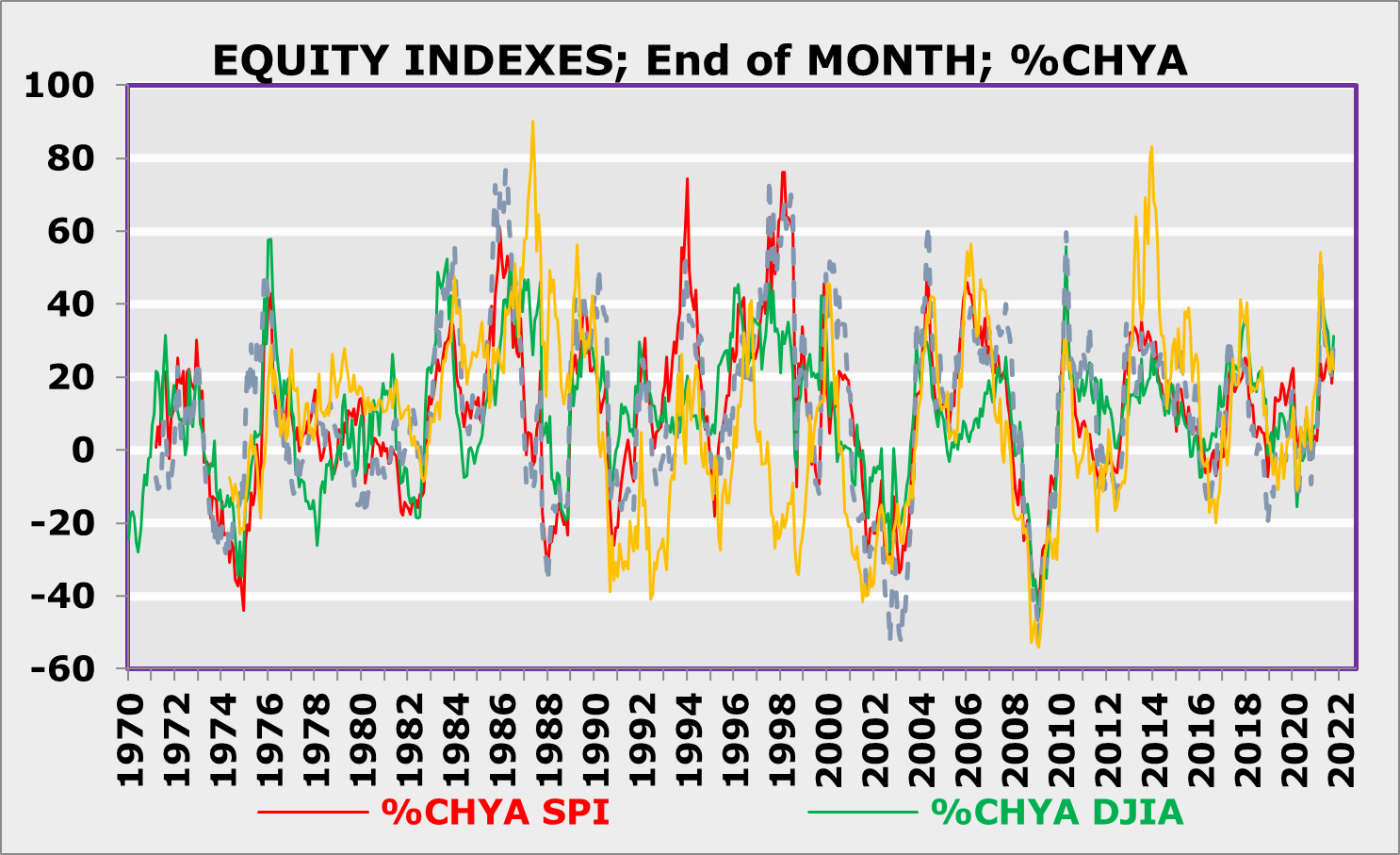

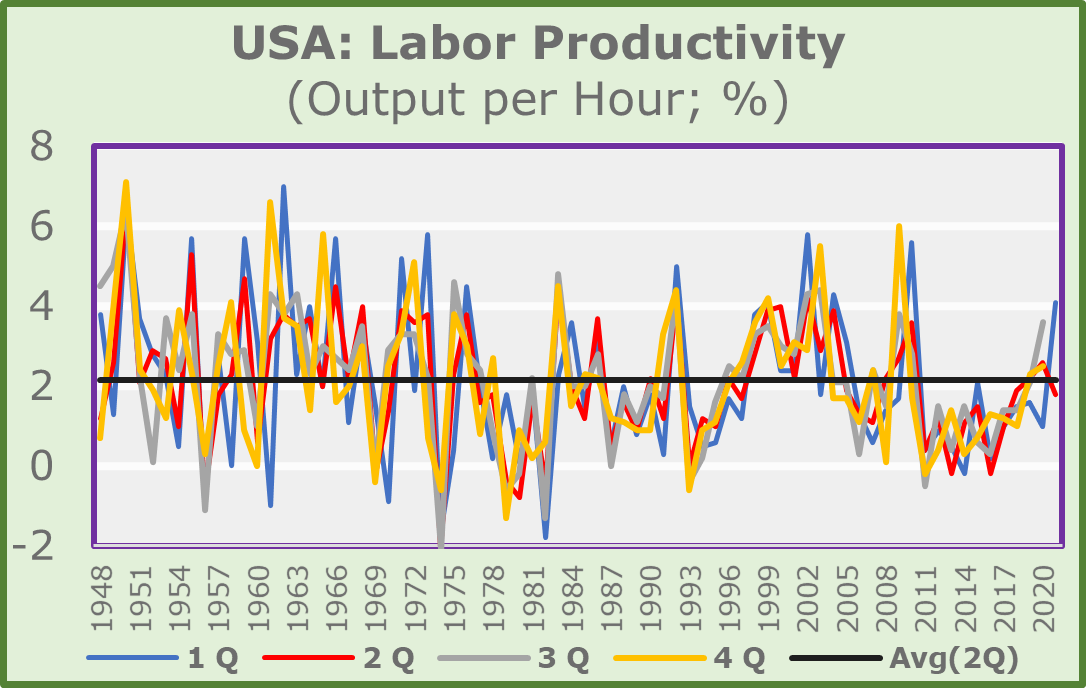

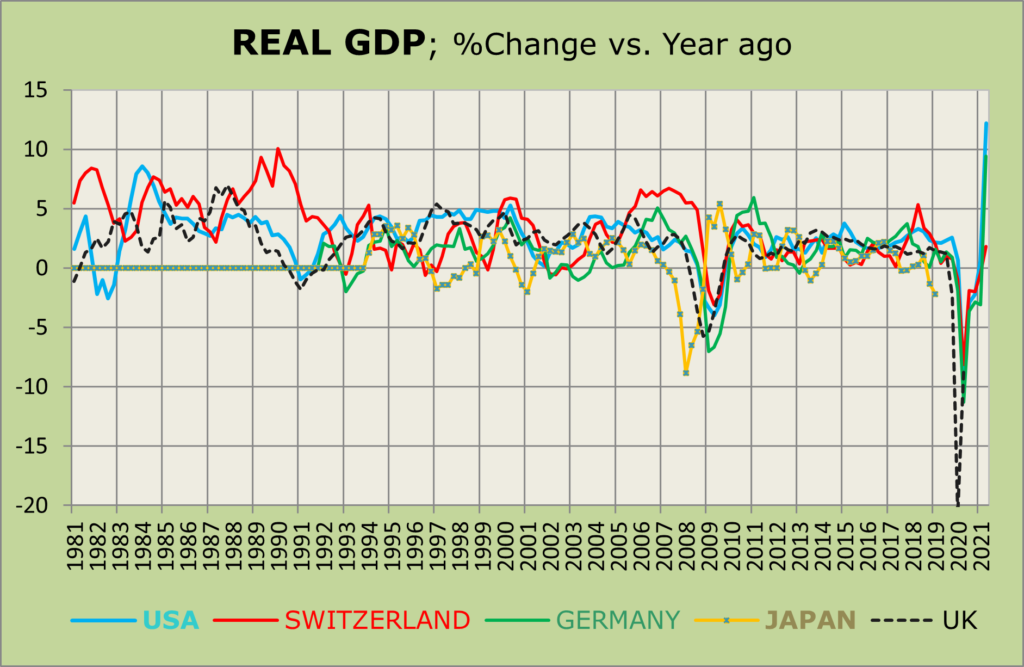

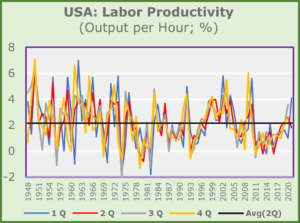

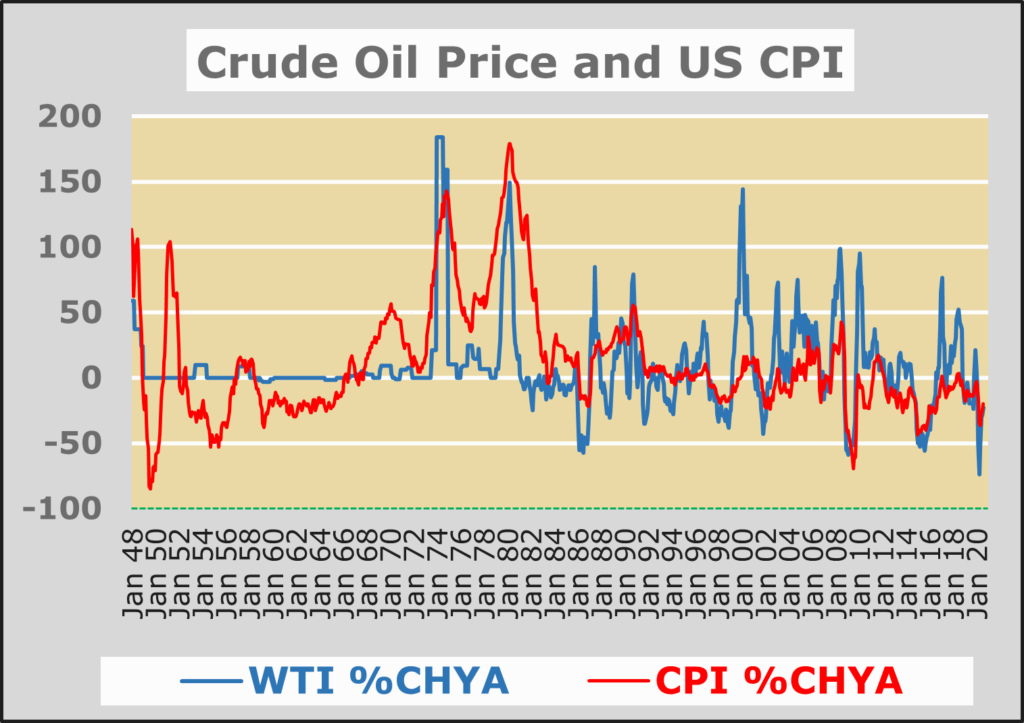

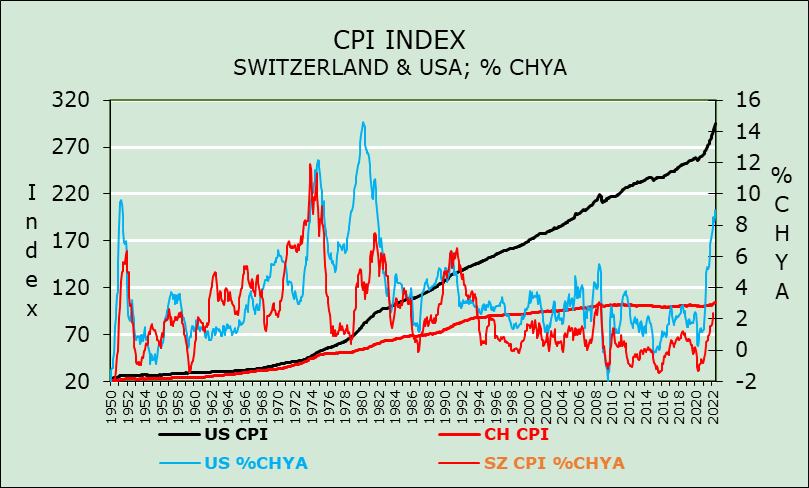

In the course of our many years of work in economics and finance, we have been involved in quantifying the relationship between price increases and their impact on interest rates. We have learned several lessons: one is that interest rates tend to rise when inflation rises, especially when inflation rises sharply and abruptly. Another lesson is that interest rates respond with a lag to price increases. That is not quite the case at present! The recent, marked interest rate hikes by central banks, in concert with the rise in inflation, especially due to the Covid 19 pandemic and the Russian invasion of Ukraine, are indeed quite unique. The current divergent conditions are seen as an implicit new environment, especially by lenders and borrowers. This is mainly due to the fact that the expected inflation development and the corresponding impact on interest rates and the economy have been difficult to predict and quantify.

WHICH ARE CURRENTLY THE REAL QUESTIONS FOR INVESTORS?

The first and hardly predictable question relates to the fate of the inflation rate. Do we expect that the recent and further announced interest rate hikes by central banks will significantly slow down the growth of price increases and, in due course, significantly reduce them? We doubt that this will be the case in the near term. Why is that? We continue to expect inflation to be driven by “exogenous” and almost “unpredictable” factors (war in Ukraine and, even worse, the Chinese threat to Taiwan, as well as increasing political unrest), which remain difficult to quantify.

Second, the supply of inputs (intermediates, crude oil and gas, and food) depends predominantly on very “constrained” supply chains and continues to be largely determined by barely quantifiable but increasingly unacceptable political behavior. At this stage, we doubt that the prediction of a price decline will follow a traditional cyclical scheme, as policymakers tend to follow a completely “non-economic” model.

A third argument to quantify concerns the adaptation of technological innovation in the energy sector, which, in due term would imply the “repatriation” of specific production lines.

Another difficulty we continue to face relates to the assessment of the impacts on income and on market liquidity, Will they offset each other, as it can be assumed that income will not react immediately and to the same extent as liquidity? At this stage, it is difficult to precisely quantify the proportionality of the change, also because of the war in Ukraine, especially in light of the current interest rate policy stance of central banks.

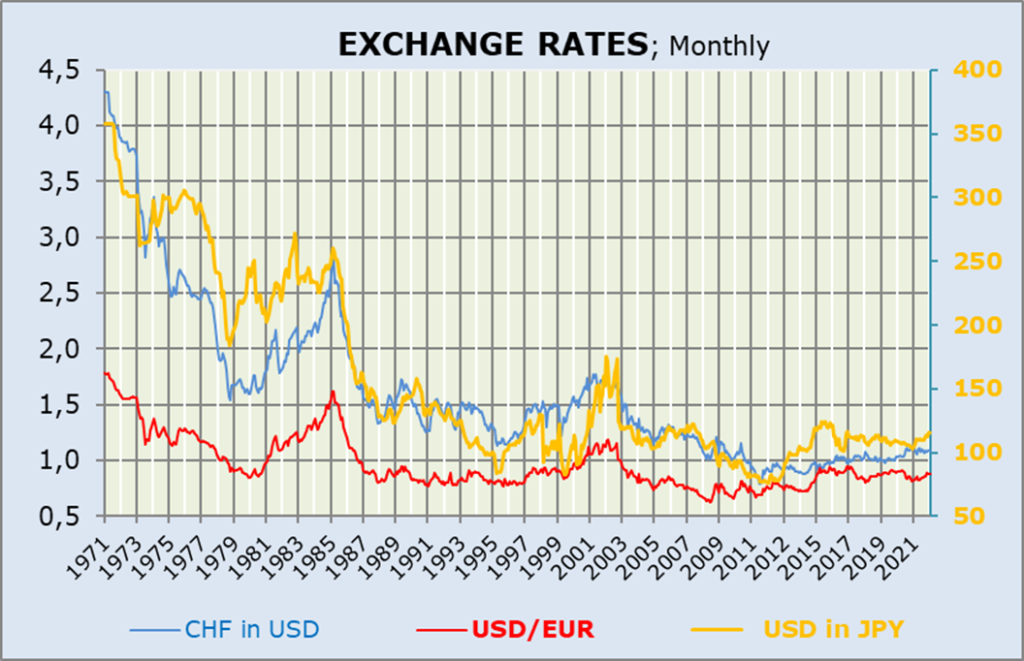

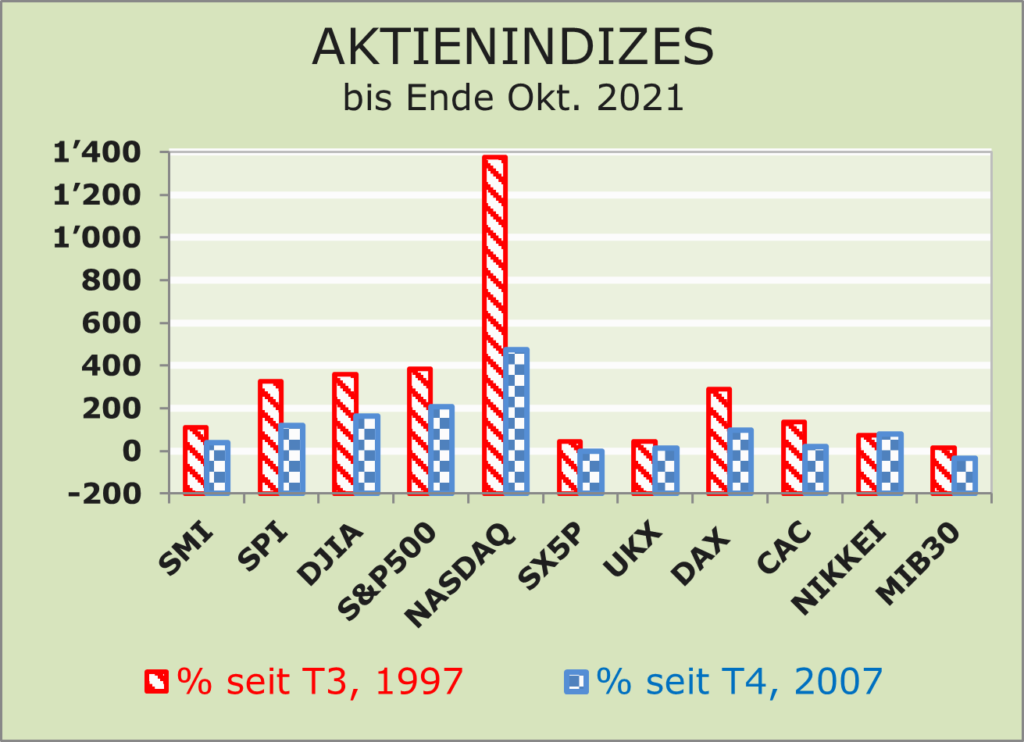

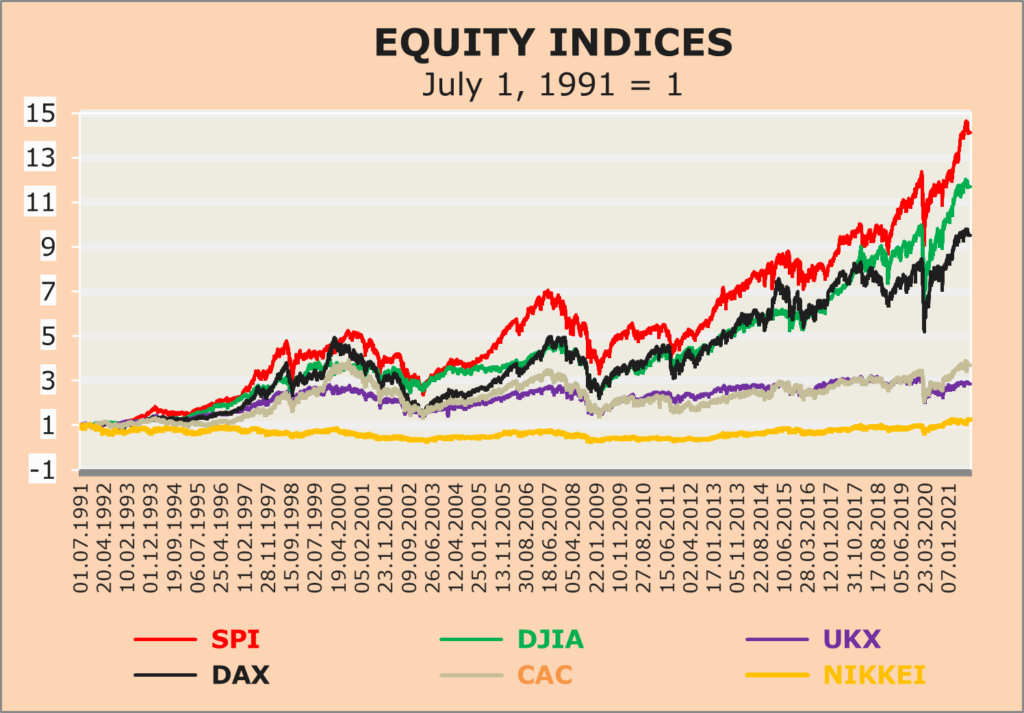

FINDINGS FOR SWISS INVESTORS

A closer look at the current environment reveals that the focus is on raising interest rates to counter inflationary pressures. The actual determinants of the current inflation are almost ignored. Assuming that the rise in inflation is mainly due to factors (such as Covid-19 and, above all, the invasion of Ukraine and China’s threat to invade Tai-wan) that put dramatic pressure on the rise in crude oil, gas and food prices above and beyond normal supply and demand trends, we should rather focus on how to solve the bottlenecks in the supply chain.

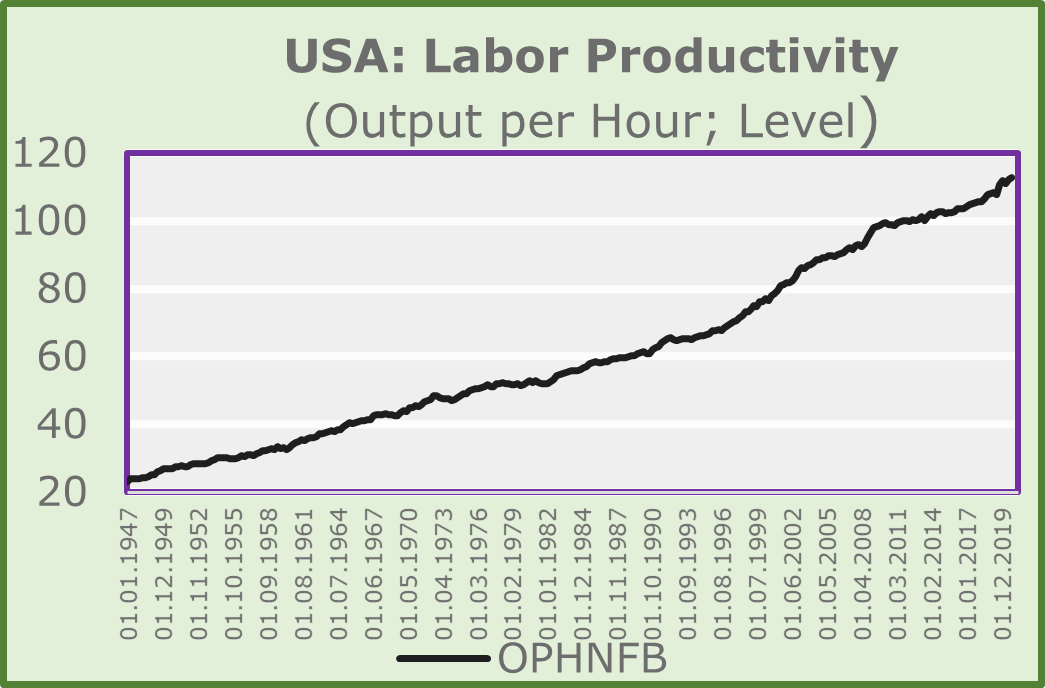

At this point in time, we believe that an “extraordinary tightening of monetary policy” could rather constrain demand without a rapid improvement of supply! However, sup-ply disruptions are expected to ease in the coming quarters, while “financing costs” may rise. We agree with Fed Chairman Powell that monetary authorities can manage demand, but not supply. Therefore, it would be worthwhile to distinguish between companies whose prices move in response to changes in demand from those that move in response to changes in supply. In this context, we argue that the most promising investment approach would be one that focuses on increasing supply as prices fall. We consider it deterministic to focus on technological improvements as well as on the adjustment of wages to the cost of living.

Examining the main components of real GDP, and focusing at this juncture to the Swiss market we find that a most intricate question mark refers to whereabouts of the mortgage market. Increasingly we read about the possibility the Swiss property market could suffer while losing some attractiveness. If the available data represent the most probable reality, that risks exist. Nevertheless, despite the recent increase in the ratio of real estate to income and the ratio of mortgage debt to GDP, the environment remains sustainable. Particularly deterministic is, in the case of Switzerland, that employment has remained sustained and as of recently it has begun to show signs of revival, concomitant with increasing immigration. Should the global economy return to some growth in the near future, it can be assumed that demand for Swiss living and working space remains high.

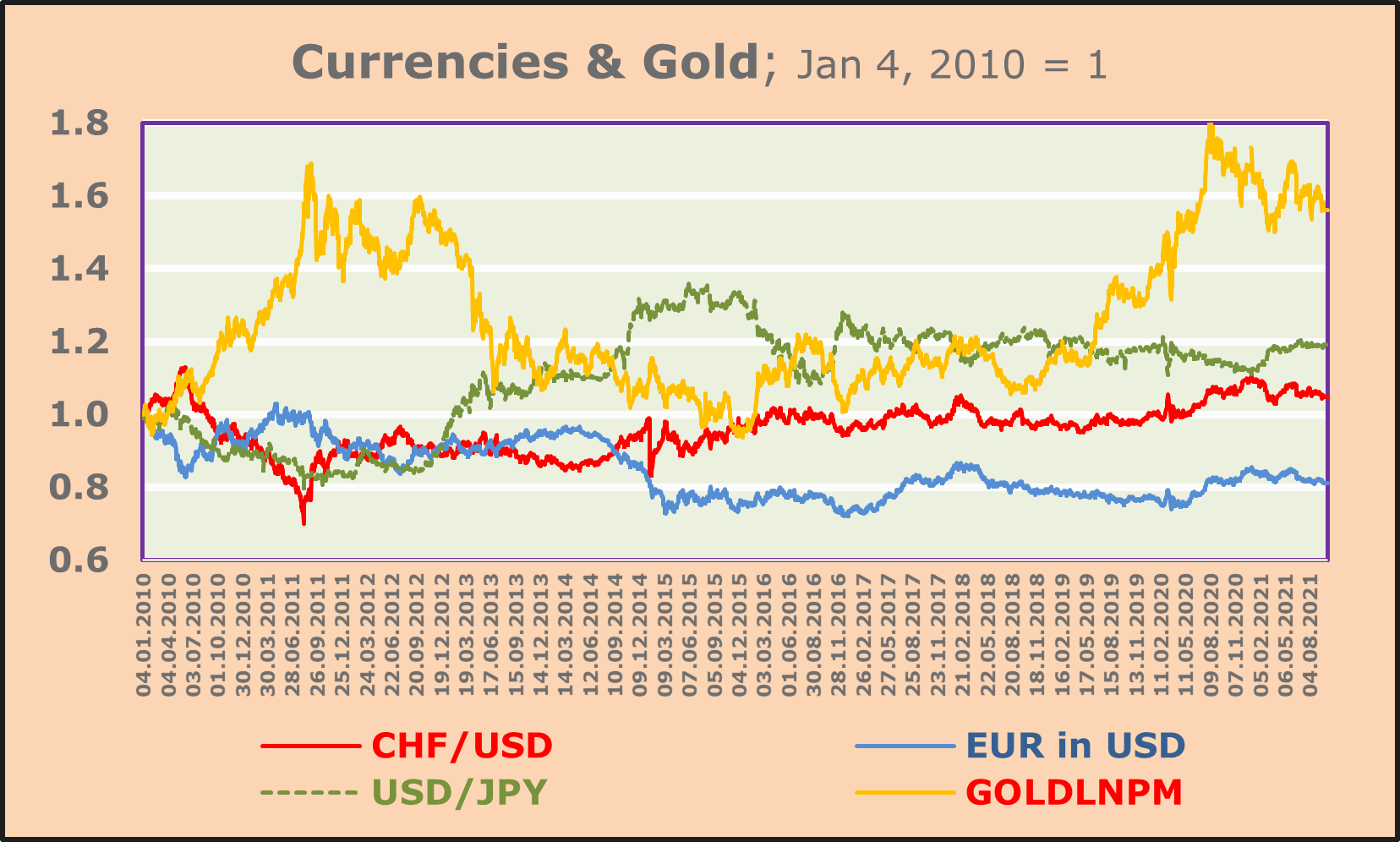

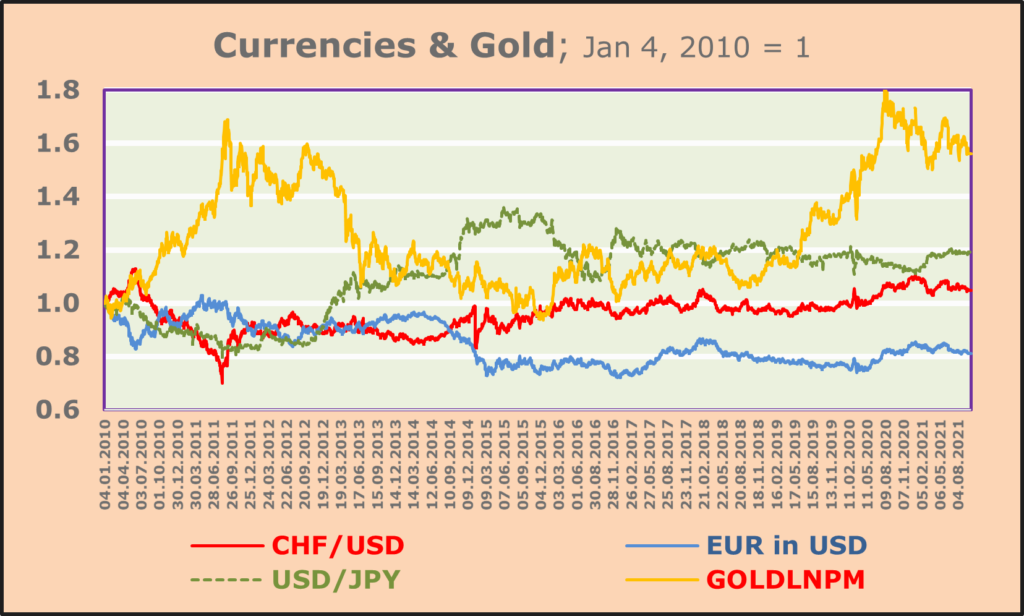

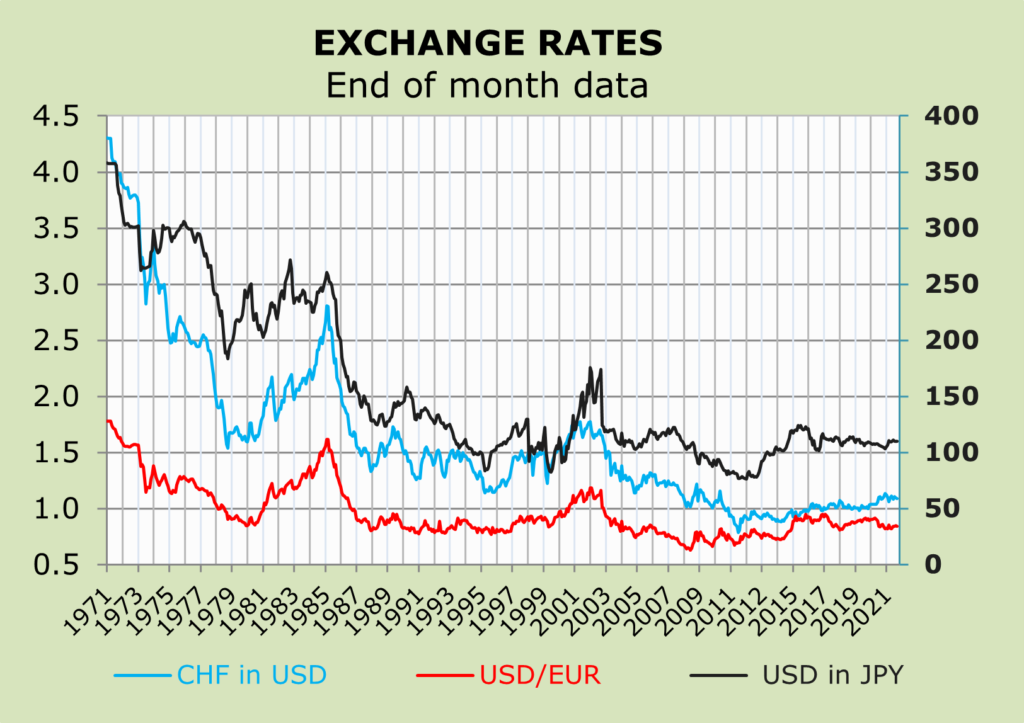

At this juncture, it can be assumed that we are close to the cyclical peak in real estate prices. Fact is, that there is a great demand for real estate (residential and commercial), thus, the threat of higher interest rates should not be underestimated. Land and also property remain in demand in Switzerland. Well known is that real estate also can offer protection against inflation. The big unknown remains the timing of the respective peaks of inflation and interest rates. Let´s not forget the special role of the Swiss franc.

Comments are welcome.