EMR June 2021

En Vogue

The economy is expected to rise as the Covid-Pandemic measures are increasingly relaxed. Inflation is feared to rise significantly. Who will play the “revitalizer of last resort”?

Difficult to compare cycles

Argument 1: Whenever economic demand, however measured, rises significantly so do inflation expectations. Concomitantly it is also argued that in such a case monetary policy is tightened, i.e. interest rates are pushed higher.

Argument 2: Differential interpretations complicate Argument 1. Does growth rise, due to domestic activity or is it due to a significant reduction of imports of goods and services?

Argument 3: What about fiscal expansion i.e., extreme intervention by the Administration e.g., in the USA?

What can be inferred from past developments?

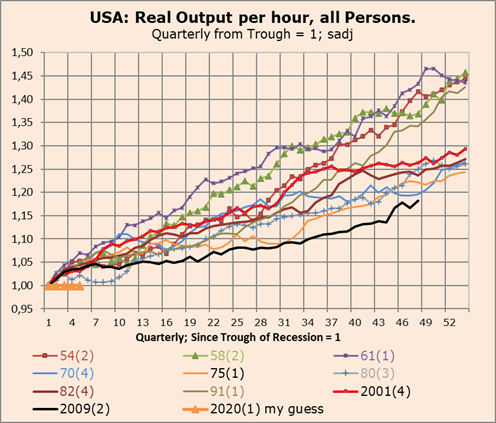

On real output: Examining the developments of the leading economy over business cycles since 1949 is indeed intriguing. The trend in real GDP, from each cyclical low, indexed to 1, is an indicator of considerable vulnerability, which in turn complicates the comparability effort. After the second year of economic recovery, discrepancies, from cycle to cycle, begin to grow ever larger. Currently, we assume that growth will be significantly more front-loaded than in most previous upswings. This due to the reduction of the Covid restrictions as well as the extreme expansionary monetary and fiscal measures. We believe that this phase will not last for long. Rising demand speaks also for significant demand for cheaper imports. At this juncture one must take into account that each country’s growth expectations ought not to be synchronous, given the specificities of each country, regarding the domestic as well as the foreign trade actions and reactions.

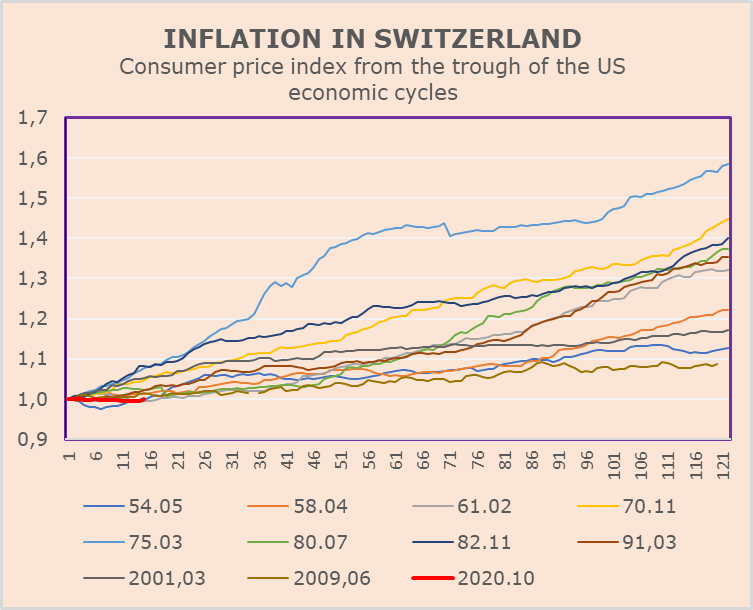

On inflation: Charting the US CPI (Consumer Price index) on a monthly basis, but coherently with the respective quarter of Output (see Chart on CPI from the Trough = 1) we find significant differences.

The period before the rate of growth of inflation starts to rise significantly is somehow longer than for real GDP, even taking into account that the data of real GDP are on quarterly basis, while the CPI data are on a monthly basis. This implies that the cyclical correlation of Output and CPI isn’t as close as often and regularly reported in the media. This is particularly evident in the three growth cycles in 1975, 1970 and 1980!

Examining the chart on the level of inflation and the corresponding yearly percent change for the USA and Switzerland we face a dilemma of “comparability”. The US CPI Index rose form 24.01 on January 1949 to 266.83 in April 2021. This shows an increase of 1011.3%. Over the same period, the Swiss CPI rose from 21.73 to 100.58 for an increase of only 362,9%. What do these figures imply? Well, they simply imply that the economic, social and political dissimilarities must be taken seriously into consideration, while pinpointing the coming quarters and years. Specific new determinants of the current outlook, as compared to the historic reality (see charts) is, that the USA are now an important producer of crude oil. A further determining aspect is that the technological developments remain considerably differentiated from country to country. Thus, we ought to pay attention to the possible differential repercussions on production, prices and expectations in general. At this juncture the question remains which are the sources of the rising pessimism?

At this juncture we expect the economy to react strongly to the monetary and fiscal policy measures and thus, anticipate that the feared effects will – for some time – cause unease among consumers and producers. The consumer`s contribution is not expected to be strongly positive, and this for the following reasons. Firstly, reserves will have to be rebuilt, i.e. debt will have to be significantly reduced. In addition, we expect consumers to switch to cheaper imports, which will further exacerbate the trade imbalances, e.g. in the case of the USA. In addition, we are concerned that the impact on domestic production may not provide the support necessary for political leadership to calm market volatility and uncertainty.

From an analytical point of view, political upheavals, possibly leading to even greater uncertainty, look highly problematic to us. It is to be feared that, in the event of higher taxation, producers will not expand production domestically but in “lower-cost” foreign countries, a move that would not help to reduce foreign trade imbalances.

On interest rates: While the trend in 10-year bond rates is approaching a low point, the interest rate differentials in 3-month rates remain quite stable. Is this a necessary and sufficient reason why many analysts have now switched to inflation expectations as the most promising determinant? It is to be expected that monetary and fiscal policy measures will promote liquidity in the system. We wonder however, whether it is sufficient to rely only on the supply side as an explanatory motive, ignoring the effects on the demand side. The argument implies that one can led the horse to the well, while it remains an open question whether the horse will drink.

Implications: What we are suggesting is nothing more than how consumers and producers will react to the increase in liquidity? We doubt that consumers will increase their spending without paying attention to prices. In other words, we continue to assume that consumers will remain “price-conscious”, especially regarding cheaper imports! This “leaves” economic growth as the potential “inflation driver”. Here however, we have to reckon with a lag that is still very difficult to quantify at this juncture.

Conclusions for investors

Our conclusions are to be seen as a specific consequence of an extraordinary accumulation of governmental indebtedness. We are not aware of any comparable past period, thus have difficulties in being specific about future developments. Our view is that we remain confronted with a highly difficult to quantify financial landscape. No doubt, the financial sector remains crucial for a smooth functioning of the world economy. Consequently, we assume – as a working proposition – that the measures ought to have an impact on inflation preponderantly over a longer period of time. In our investment outlook we also focus on the change in international trade flows, as we must reckon with a new fact, i.e. that the U.S. will increasingly cease to be the “buyer of last resort” (i.e. the importer). In our scenario domestic economic growth gains in importance as an indicator for the financial markets’ whereabouts.

Consequently, we do not expect a sharp increase in inflation, as it cannot simply be passed on, neither domestically nor to foreign countries. As a working consequence we continue to see potential in the stock markets compared to fixed income and money market investments. Currency hedging will have to be considered in the international portfolio diversification approach.

Any suggestion is highly welcome.