EMR Mai 2021

The high level of monetary and fiscal policy interventions by the USA and also by European countries are the cause of rising inflation and interest rate expectations. They cloud the prospects for the long-awaited economic recovery. The corona pandemic also unsettles market participants and the state. Many analysts therefore believe that both inflation and interest rates will rise, which in turn will darken the stock market outlook. In contrast, we do not expect any significant increases in inflation and interest rates. There is therefore still potential on the stock exchanges. We explain why in this issue of the EMR.

What’s behind it?

Fiscal policy measures are intended to inject liquidity into the economy and to bring the economy back on track for growth by stimulating consumption. On the one hand, it is assumed that the manufacturing sector will benefit greatly from the easing of fiscal policy. On the other hand, announced tax increases are hampering local investment activity. We analyze expectations and possible or feared shocks.

The general assumption is that the economy reacts strongly to monetary and fiscal policy measures. In our case, however, it can be assumed that the effects of the government measures will tend to cause unrest among consumers and producers. A contribution to growth from consumption is hardly to be expected, since debts have to be reduced first. In addition, we expect that consumers will initially turn to cheaper imported goods. In the case of the US, this would further worsen the trade imbalance. This has an impact on domestic production and this in turn will unsettle the political leadership. The longed-for reassurance will not materialize. Political upheavals can lead to even greater uncertainty and, with higher taxation, cause companies to increase their production not domestically but in cheaper foreign countries.

What do we learn from the development so far?

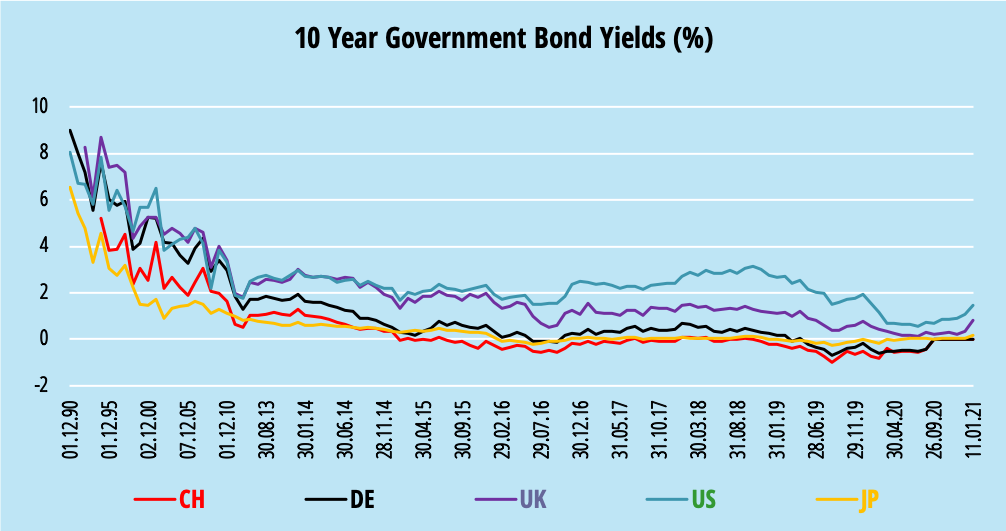

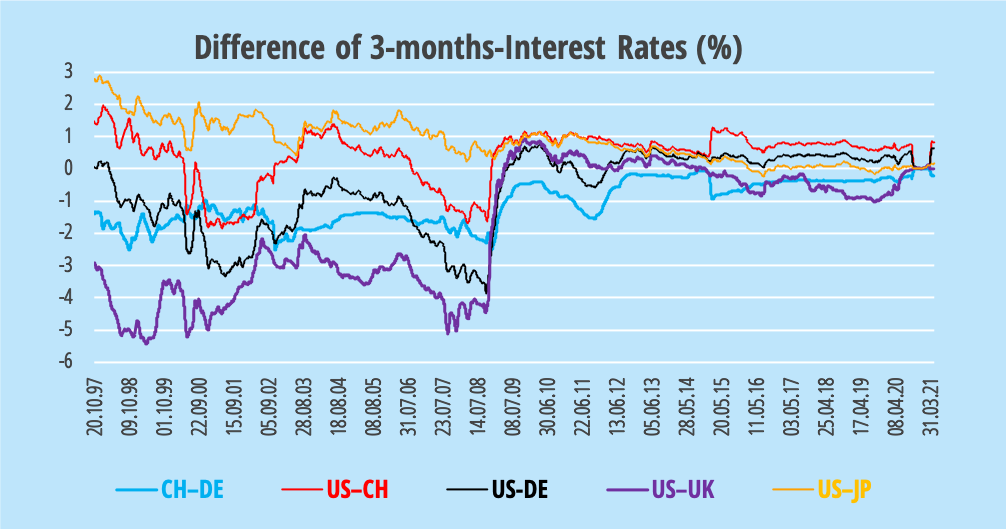

While the interest rate trend for 10-year bonds is approaching its lowest point, the interest rate differential for 3-month rates has remained relatively stable since the 2008 financial crisis. Is this one reason why many analysts predict rising inflation and interest rates? Monetary and fiscal policy measures will further increase liquidity in the economic system. As is well known, however, you can lead the horses to the well, they have to drink themselves. So it is not enough just to look at the supply side. The question is, will both consumers and producers react to the increase in liquidity? We doubt that consumers will increase their spending without paying attention to prices. We assume that consumers will remain price-conscious and buy cheaper imported goods. That leaves entrepreneurs as a potential driver of inflation. Here, however, a delay that is difficult to determine must be expected.

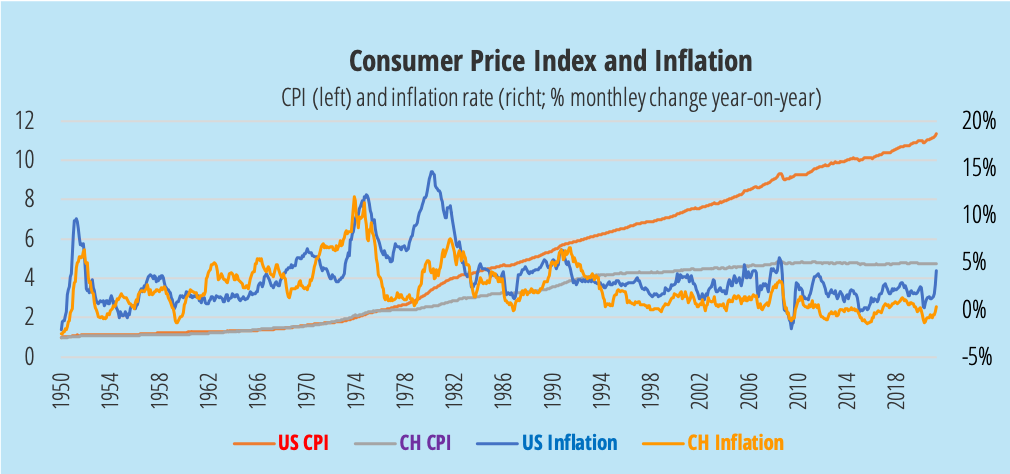

A comparison of the development of consumer prices in Switzerland and the USA shows that it is difficult to derive future inflation developments from this. The difference between the development of the consumer price indices and the inflation rate is obvious. It is striking that the inflation rate has tended to decrease since the 1990s!

The inflation rate in Switzerland has been slightly negative since November 1919 (average -0.57%) while it has remained positive in the USA (average 1.49%) and was 2.64% last March. At this point in time, one could well imagine that the US inflation rate will continue to rise in the same way as in 2007-2008 and could rise to over 5%. Such an increase would, however, have a strong negative impact on economic development. But that cannot be assumed given the currently extremely expansive monetary and fiscal policy. In such a situation, a dramatic currency adjustment would probably be expected, which would result in strong reactions not only in terms of economic policy but also in terms of investment policy.

What does this mean for investors?

In our context, the enormous increase in national debt should also be mentioned. In Europe as in the USA, the debt ratio is rising steadily. In the USA, it rose from 63% at the end of 2007 to 105% at the end of 2019, only to skyrocket to 131% at the end of 2020, mainly due to Corona measures. We are not aware of any similar period. We therefore assume that the measures will only really come into play over a longer period of time. We focus on changing international trade flows. The USA will increasingly no longer play the role of the buyer “of last resort”. Thus, domestic demand growth should gain in importance for the financial markets.

Based on the considerations mentioned above, we expect that inflation will not really pick up and that the financial markets will not be subject to any major changes. We therefore continue to see potential on the stock exchanges compared to fixed-income and money market investments.